Top-Ranked Essay Writing Service to Get Secure Help Online

Place anonymous order and get professional help from academic writers.

Fast turnaround and high quality guarantees. Available 24/7.

250 000+ happy customers.

Client reviews

4.9

Sitejabber

4.6

Trustpilot

4.8

Give us a try and enjoy the following guarantees:

Safety

Confidential orders and secure payments. 100% privacy is granted.

Quality

Top-grade academic writing in compliance with instructions.

Timeliness

Fast and timely delivery, starting at 3 hours. No missed deadlines.

Reliability

16 years of experience and 50000+ positive reviews.

Multi-level essay writer selection process

STEP 1

First, we expect our future author to have a University degree and at least 2 years of expertise in custom writing. All applicants for the writer’s position must meet these requirements. Otherwise, we turn down the candidate right away.

STEP 2

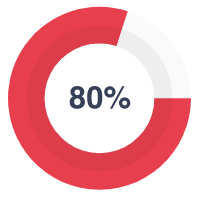

The next stage is an English language test and subject proficiency assessment. Excellent knowledge in the study area is another essential requirement to join our team. 80% of candidates pass the exam successfully.

STEP 3

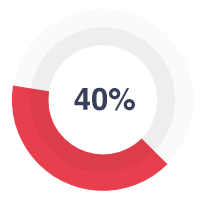

A good essay writer is a qualified professional with the necessary hard and soft skills. A one-on-one meeting allows us to find flexible and outgoing authors with great time-management qualities and a genuine passion for writing.

STEP 4

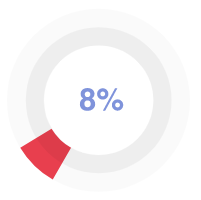

As a final proof-test, the remaining candidates have to complete a guest assignment to show their competence and ability to cope with real orders. Only 8% perform the best and complete a top-quality custom paper.

What our customers say about our writers

Samples of our papers

How it works

1. Make an order

2. Wait for response

3. Monitor the process

4. Download your paper

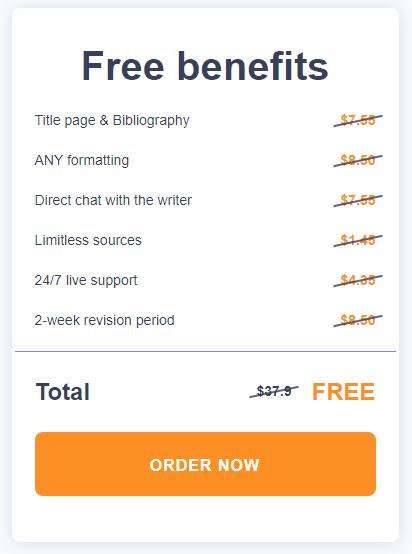

Take it to the next level: buy essay and benefit from our free services

What Types of Custom Writing Do We Offer?

College essay writing. The essay is the most common written assignment at college. Tell us ‘write my essay online,’ specify your subject and topic, and receive a compelling English essay within your deadline.

Research essay writing. This assignment is one of the most challenging because it requires in-depth academic research. Our writers have access to up-to-date, relevant sources and can create outstanding research essay on any topic.

English essay writing. This service is popular among international students. If English is not your first language, writing a good college essay is extremely difficult. Buy essay online and get a higher grade without effort.

Dissertation writing service. Request dissertation help, and we will find an eligible writer with a PhD degree in your field to create an outstanding dissertation just for you.

Editing service. If you have already written your paper but need another pair of eyes to look at it, try our editing service. A professional academic editor will go over your paper and master it to absolute perfection.